REDAO vs REITs

Several approaches have been made to make real estate investment environment more friendly to retail investors. In 1960, REITs was introduced in the United States to provide investors access to non-residential properties via fractional ownership of the underlying assets. REITs and real estate investment funds have solved the "Affordability" and "Accessibility" issue faced by retail investors. The high liquidity of REITs has also addressed the nature of low liquidity in real estate investments. The solution was overwhelming - REITs market cap has increased from $8.7 billion to $1.8 trillion in the past 22 years.

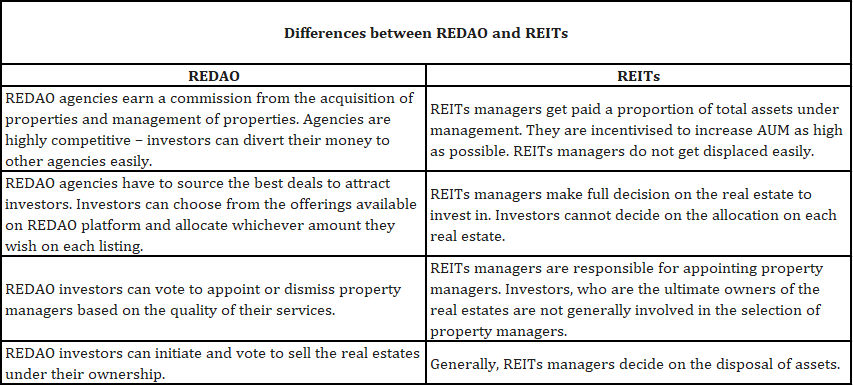

However, this has also introduced a new set of problems, with principal-agent issue being the most obvious one. REITs managers are responsible in sourcing acquisition targets with fund raised from the public. They are also paid an X percentage of assets under management. Apparently, this would incentivize REITs and fund managers to keep making new purchases regardless of the quality and destroy shareholders' value - buying new assets that have lower yields than cost of funding. Because no matter how their performance is, they will always get paid.

The investment in REITs also limits the flexibility of investors' portfolio allocation. An investor may prefer one project and dislike the other but have no option to exclude that from his/her portfolio. The lack of choice causes some investors to compromise on assets that are not preferable to them.

Summary - differences between REITs and REDAO.